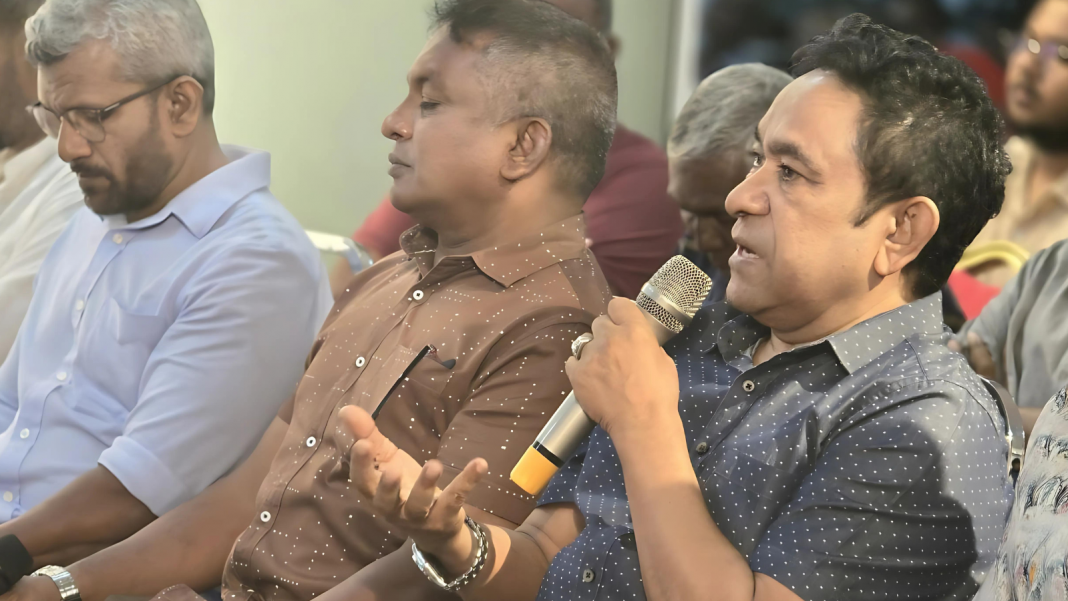

Former President Abdulla Yameen has raised serious concerns about the financial safety of the Bank of Maldives (BML) after reports that the bank has issued large loans to the government to cover its expenses. Speaking at a recent gathering of his People’s National Front (PNF), Yameen emphasized the potential dangers of this move and urged the bank’s board to be cautious.

Yameen pointed out that the national bank recently lent nearly a billion Rufiyaa to the government, even though he believes the bank’s risk assessment department advised against such a risky decision. He revealed that around 800 million Rufiyaa has already been drawn from the bank to pay state employee salaries, raising red flags about the bank’s financial health.

The biggest risk with lending this much money to the government is that if they fail to repay, the bank has no real way to recover that money,” Yameen explained. He highlighted that the bank cannot take legal action against the government to get back the funds. Additionally, he noted that the Maldives Monetary Authority (MMA) will not cover any losses incurred from these loans.

As a former board member of BML, Yameen stressed the importance of following the risk assessment department’s advice. He expressed concern that political influences on the bank’s board are leading to poor financial decisions, putting the bank’s stability at risk.

Yameen’s comments serve as a warning to both the bank and the government. If the Bank of Maldives continues to issue large loans without adequate risk management, it could face serious financial troubles down the road. The call for caution is clear: financial decisions should be based on sound advice rather than political pressures to ensure the bank’s long-term health and the stability of the Maldivian economy.