As the Maldives enters a new phase of economic relations with China, the recent Memorandum of Understanding (MoU) between the Maldivian government and the People’s Bank of China (PBOC) is being hailed by officials as a step towards “enhancing economic openness.” But beneath the surface of this seemingly beneficial agreement lie a series of long-term risks that threaten to pull the Maldives deeper into China’s geopolitical and economic orbit, risking independence, sovereignty, and long-term stability.

While the current administration, led by President Dr. Mohamed Muizzu, may celebrate this deal as a significant milestone in promoting trade and investment, many are growing increasingly concerned that the agreement may lead the nation down a dangerous path. China’s infamous “debt-trap diplomacy” and its aggressive foreign policy have ensnared smaller nations across Asia and Africa. The Maldives is no exception. This MoU could well be the beginning of an economic entanglement with China that will be hard to escape.

Increased Dependence on China

Let’s not sugarcoat it—this MoU is not a simple trade agreement; it’s a strategic maneuver by China to further cement its influence over the Maldivian economy. While China remains a key trade partner and tourist source for the Maldives, strengthening these ties risks pushing the nation into economic dependency. Should China’s economy falter or its geopolitical ambitions shift, the Maldives will find itself at the mercy of their decisions.

The reality is that relying on one nation for tourism, trade, and investments makes the Maldives vulnerable. Past disruptions—such as the COVID-19 pandemic—have already shown how the economy can be crippled when a major market dries up. Deepening these ties will only make the Maldives more susceptible to China’s economic fluctuations.

Currency Risks: A Double-Edged Sword

The MoU promises more efficient trade through transactions in local currencies, the Maldivian Rufiyaa and the Chinese Yuan. But this introduces a major risk: currency instability. The Maldivian Rufiyaa is not a globally traded currency, and its value could easily plummet against the Yuan, leaving businesses to struggle under the weight of fluctuating exchange rates.

Moreover, the Yuan is tightly controlled by the Chinese central bank, not freely traded like the US Dollar or Euro. This gives China the upper hand in controlling exchange rates, potentially leading to inflation in the Maldives and skyrocketing import costs for essential goods. Maldivian businesses will find it harder to price their products competitively, hurting the local economy while benefiting Chinese traders and investors.

Erosion of Sovereignty: A Trojan Horse in Economic Ties

Economic agreements with China are never just about business. History has shown that China’s financial assistance often comes with strings attached—political influence being the most dangerous. While leaders may boast about enhanced bilateral relations, they risk sacrificing the very sovereignty that is held dear.

China’s strategic moves often lead smaller nations into a cycle of dependency, where economic deals slowly erode political independence. With China expanding its presence in the Indian Ocean, the ability to make autonomous decisions—whether involving regional security or global alliances—could be compromised. This MoU, positioned as a win for the economy, could easily become a mechanism for China to exert even more control over domestic and foreign policy.

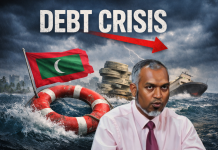

The Debt Trap Awaits

China’s Belt and Road Initiative (BRI) has left a trail of nations drowning in debt. This MoU, which encourages Chinese investments in the Maldives, could very well open the floodgates to Chinese-funded infrastructure projects. While these projects are often promoted as necessary for development, they come with high-interest loans and long-term repayment commitments that could cripple the nation.

Take, for example, Sri Lanka—a nation that was forced to hand over its strategic Hambantota Port to China due to unsustainable debt. The Maldives cannot afford to fall into the same trap. With tourism and fishing industries already struggling, any additional financial burdens will be difficult to bear, leading to economic subjugation under the guise of development.

Local Economy Under Threat

This MoU may benefit Chinese businesses, but what about local industries? Maldivian small businesses could find themselves outmatched by a flood of cheap Chinese imports. Local producers, who are already struggling, may not survive in a market where they have to compete with the vast manufacturing capabilities of China.

Instead of supporting local industries and fostering a more diverse economy, this deal could prioritize foreign investments and cheap imports, sidelining Maldivian entrepreneurs. Job losses, reduced competitiveness, and economic stagnation could follow, weakening the economy from within.

Widening the Trade Deficit

While China enjoys a robust trade surplus with the Maldives, exports to China are minimal in comparison. This MoU could exacerbate this trade imbalance, further increasing dependency on Chinese goods while doing little to promote Maldivian exports. An increasing trade deficit weakens the economic position, forcing reliance on foreign loans—often from the very country that benefits from this imbalance.

A House Built on Shaky Foundations

Yes, Chinese tourists form a significant portion of visitors to the Maldives, but deepening reliance on a single market is dangerous. While the MoU may seem like a way to attract more Chinese tourists, it could also make the tourism industry vulnerable to Chinese policies, such as restrictions on outbound tourism or economic downturns.

The lesson learned during the COVID-19 pandemic—placing all reliance on one market—leaves the tourism sector exposed to global shocks. The Maldives needs to diversify its tourism markets, attracting visitors from around the world rather than deepening dependence on China.

The Maldivian government may tout this MoU as a symbol of progress, but the reality is that it carries long-term risks that could undermine economic stability and sovereignty. China’s foreign policy is clear—it seeks to expand its influence through economic dominance, and smaller nations like the Maldives are prime targets. This agreement, which appears to offer immediate benefits, could lock the nation into a cycle of dependency, debt, and diminished autonomy.

The Maldives must think beyond short-term gains and carefully consider the long-term consequences of deeper economic ties with China. Prioritizing economic diversification, strengthening local industries, and seeking partnerships that don’t threaten sovereignty will be crucial to avoiding the pitfalls of this agreement.