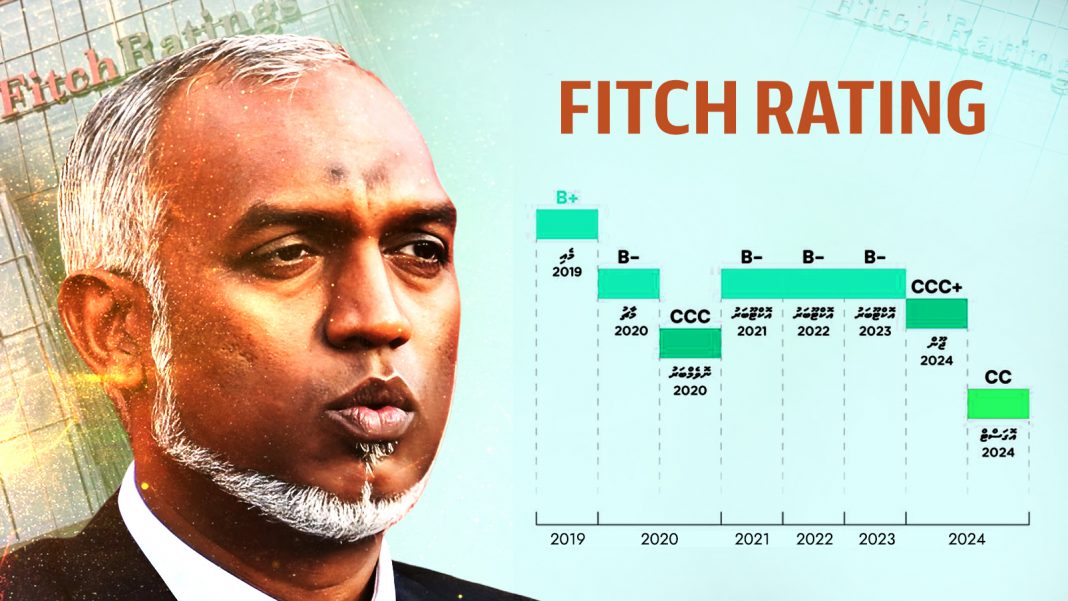

Fitch Ratings has downgraded the Maldives’ credit rating to ‘CC’, reflecting a dramatic deterioration in the nation’s financial stability and an increased risk of default. This marks the second downgrade in 2024, following a previous cut in June. The latest downgrade highlights ongoing challenges under the current administration led by President Mohamed Muizzu.

Key Implications of the Downgrade:

-

Increased Risk of Default: Fitch’s latest downgrade to ‘CC‘ underscores a growing likelihood of the Maldives defaulting on its debt. The nation’s financial situation has deteriorated sharply, with foreign-exchange reserves plummeting and debt obligations mounting.

-

Recent Downgrade History: This downgrade follows a previous reduction in June, when Fitch lowered the rating from ‘B-‘ to ‘CCC+’. The June downgrade already signaled severe financial stress, and the recent action indicates worsening conditions.

-

Plummeting Foreign Reserves: The Maldives’ foreign-exchange reserves have dropped by 20%, falling from $492 million in May to $395 million in July 2024. This decline represents the lowest level since late 2016, heightening liquidity concerns and economic instability.

-

Rising Debt Service Costs: The government faces significant debt repayments, with $50 million due in the last quarter of 2024 and a projected $557 million in debt servicing for 2025. By 2026, debt payments could exceed $1 billion, further straining the nation’s finances.

-

External Imbalances and Liquidity Issues: Persistent high current account deficits and reliance on imports have led to severe dollar shortages, tightening liquidity in the banking system and potentially disrupting everyday transactions.

-

Public Debt Concerns: The Maldives’ public debt is projected to surpass 109% of GDP by the end of 2023. Without effective fiscal reforms and increased revenue, this high debt burden will continue to impact economic stability.

Government Mismanagement Under Muizzu Administration:

-

Political Appointments and Spending: The Muizzu administration has been criticized for mismanagement, including the appointment of 2,700 political appointees and excessive spending. These practices have exacerbated the financial crisis, diverting resources from essential services and economic stabilization efforts.

-

Controversial Expenditures: Recent expenditures, such as the $37 million spent on surveillance drones from Turkey, have sparked criticism. Such investments are viewed as unnecessary given the current financial strain, drawing scrutiny over prioritization of resources.

-

Ineffective Fiscal Management: The current administration’s fiscal policies have struggled to address the mounting debt and economic challenges. Despite efforts to secure external support and implement reforms, significant uncertainty remains about the government’s ability to stabilize the economy.

Impact on Ordinary Maldivians:

-

Economic Uncertainty: The downgrade and ongoing financial instability could lead to higher costs for imported goods and services due to currency issues, increasing the cost of living for residents.

-

Potential for Inflation: With ongoing external debt pressures and currency stabilization efforts, inflation could rise, impacting daily expenses and reducing purchasing power.

-

Public Services and Employment: The financial strain may lead to cuts in public spending and development projects, potentially affecting public services and job opportunities.

The Maldives faces a challenging economic landscape under President Mohamed Muizzu’s administration. The government’s ability to manage its financial crisis and implement effective reforms will be crucial in determining whether the nation can stabilize its economy and avoid default. The direct impacts on Maldivian citizens underscore the need for comprehensive and effective economic management to mitigate adverse effects on their daily lives.