In a major step towards strengthening ties with India, the Maldives has signed a significant USD 400 million and INR 30 billion currency swap agreement with the Reserve Bank of India (RBI). This agreement was made between the Maldives Monetary Authority (MMA) and the RBI following bilateral talks between Maldivian President Dr. Mohamed Muizzu and Indian Prime Minister Narendra Modi in New Delhi.

Key agreements signed

The agreements signed between the two countries include:

- India’s $400 million bailout for the Maldives: This financial assistance will help stabilize the Maldivian economy and address foreign exchange issues.

- Strengthening military cooperation: This move comes after years of fluctuating relations, especially during the ‘India Out’ campaign under the PPM-PNC.

- FTA (Free Trade Agreement) talks: India and the Maldives have agreed to begin discussions on a potential Free Trade Agreement, which could open new avenues for trade.

- RuPay cards and UPI: India’s RuPay card system is now active in the Maldives, with the next step being the introduction of UPI, allowing seamless payments between the two nations.

- Diplomatic expansions: India will open a consulate in Addu City, and the Maldives will establish a consulate in Bangalore.

Understanding the currency swap agreement

The currency swap agreement between the MMA and the RBI allows the Maldives to access financial assistance under two windows:

- A USD/EUR window for foreign exchange liquidity, which will address the Maldives’ short-term needs for foreign currency.

- An INR window for trade settlement in Indian rupees, further enhancing bilateral trade.

This swap facility will support the Maldives in managing its foreign exchange reserves and addressing balance of payment challenges. The agreement falls under the “Framework on Currency Swap Arrangement for SAARC Countries” for 2024-2027, with the Maldives able to draw up to USD 400 million and INR 30 billion.

This isn’t the first time the Maldives has tapped into India’s swap facility. Since 2016, the Maldives has drawn USD 700 million from the program, which was first introduced in 2012 as a support mechanism for SAARC countries.

Diplomatic and economic shifts

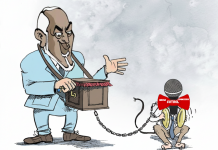

President Muizzu’s visit to India and the agreements made mark a significant shift in Maldives-India relations. The topic of opening an Indian consulate in Addu City, which had previously been opposed by the PPM-PNC during the previous administration, was revisited. This has raised questions about the reversal of anti-India rhetoric, especially since the ‘India Out’ campaign portrayed India’s growing influence as a threat to Maldivian sovereignty.

Additionally, the launch of India’s RuPay card service in the Maldives is another strategic move aimed at boosting the Maldivian Rufiyaa. The RuPay card, a major global payment network, will facilitate electronic payments between the two countries, helping both businesses and tourists.

Looking ahead

The agreements signed during President Muizzu’s visit to India mark a new chapter in Maldives-India relations, focusing on economic cooperation, diplomatic expansions, and addressing financial challenges. While some of these moves may raise questions domestically, especially given the previous ‘India Out’ campaign, they signal a broader recognition of India’s critical role in the region and in supporting the Maldivian economy.

The coming months will reveal how these agreements will impact the Maldives’ economy and its relations with other regional partners.