Under President Muizzu’s administration, the Maldives is facing a severe economic crisis, with foreign reserves plunging to dangerously low levels. Recent data from the Maldives Monetary Authority (MMA) reveals the alarming extent of the problem, raising serious concerns about the government’s economic management and the country’s future stability.

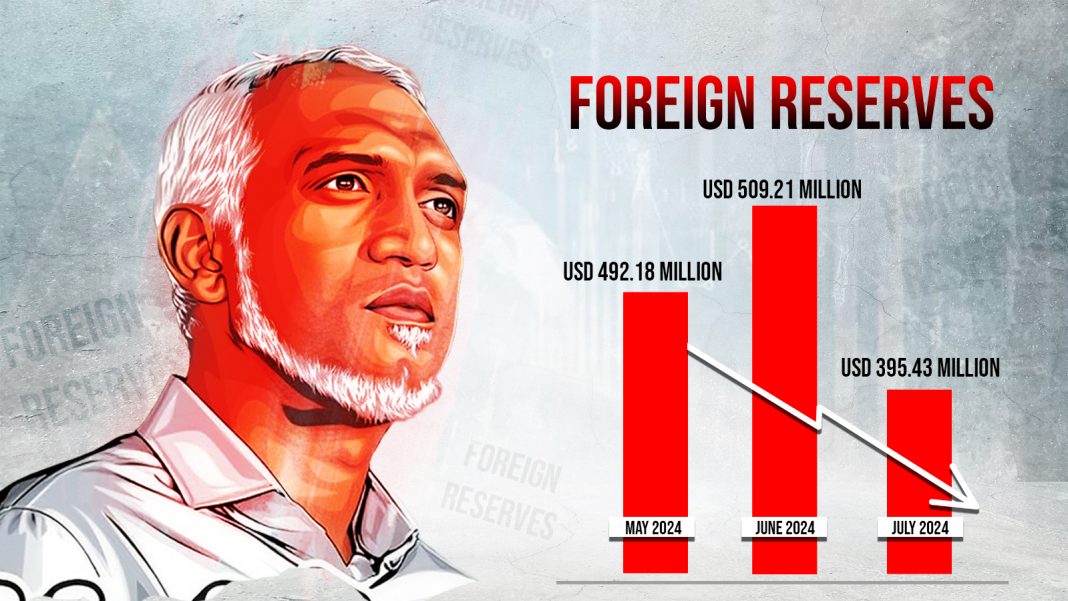

As of early August, the MMA reported a sharp decline in foreign reserves, dropping from USD 509 million in June to just USD 395.4 million in July. Even more troubling is the steep fall in usable reserves, which plummeted from USD 66.9 million to USD 43.7 million over the same period. These reserves are vital for financing essential imports, such as oil and medicines, and their rapid depletion casts doubt on the government’s ability to meet the country’s basic needs.

The financial crisis has been exacerbated by a recent downgrade of the Maldives’ credit rating. In June 2024, Fitch Ratings downgraded the country’s Long-Term Foreign-Currency Issuer Default Rating (IDR) from ‘B-‘ to ‘CCC+’, a direct reflection of the Muizzu administration’s economic mismanagement. The downgrade highlighted several critical issues, including weakening reserves, severe liquidity problems, and the government’s inability to address growing foreign exchange pressures.

Fitch’s analysis underscores the alarming state of the Maldives’ economy under President Muizzu’s leadership. Foreign reserves have now fallen to USD 492 million, a stark indicator of high current account deficits and ineffective economic policies. The country’s foreign reserve coverage for current payments is perilously low, and with substantial debt repayments looming in the next few years, the situation is becoming increasingly untenable.

Reports of a letter allegedly sent by the MMA to the Ministry of Finance further underscore the gravity of the crisis. The letter reportedly warns that usable reserves could be exhausted by the end of August, urging immediate action to stabilize the economy. Although the MMA has not confirmed the letter’s existence, sources within the government suggest it reflects growing internal concern over the administration’s handling of the economy.

Under Muizzu’s government, the Maldives is not only grappling with falling reserves but also facing rising public debt, expected to reach 117.6% of GDP by 2026. This growing debt burden, coupled with the administration’s fiscal mismanagement, could lead to higher taxes, reduced public investment in infrastructure, and cuts to essential services. The cost of living is likely to rise as a weakening currency increases the price of imported goods, further straining the finances of ordinary Maldivians.

Even the forecasted economic growth, projected to accelerate to 5.0% in 2024 and 6.3% in 2025, driven primarily by tourism, offers little comfort. The tourism sector’s dependence on fluctuating visitor numbers and regional economic conditions means that any gains could be quickly undermined by external shocks or continued government missteps.

The situation is dire, and decisive action is urgently needed. The economic mismanagement under President Muizzu has brought the Maldives to the brink of crisis. The government must swiftly implement effective fiscal reforms to restore confidence in its financial systems and prevent a deeper economic collapse. The future of the Maldives hinges on the administration’s ability to correct course and address the growing concerns of both domestic and international stakeholders. Without immediate action, the nation risks descending into an even more severe economic and social crisis.